santa clara property tax appeal

Sign and date the form and submit online or by mail. CA State Board of Equalization Publication 29 California Property Tax An Overview CA State Board of Equalization.

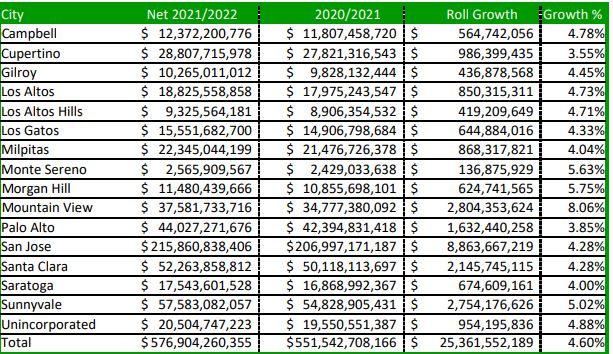

Roll Close Media Release 2021 Assessment Roll Growth Slows To 25 4 Billion But Escapes Worst Covid Projections

Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated.

. Enter Property Parcel Number APN. Please note the review process may take 45-90 days. Lower your property tax bill.

Find Property Tax Appeal Consultants in Santa Clara and Surrounding Areas If you plan to protest property taxes of your home or investment properties in Santa Clara CA or in any other city in California on HouseCashin platform you can find trusted property tax reduction advisors that would love to help you with your property tax appeal. Office of the Clerk of the Board of Supervisors. Get peer reviews and client ratings.

CA State Board of Equalization Assessment Appeals Manual. On June 21 2021 full in-person customer service resumes in the Assessors Office. Learn more about SCC DTAC Property Tax Payment App.

It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt. August 31 - Last day to pay unsecured taxes without penalty. CA State Tax Board of Equalization Property Tax Rules.

Correctlys property tax appeal experts help Santa Clara County property owners challenge their assessed value and reduce their property tax bill. Attach documentation that supports the basis of your request to cancel your tax penalty. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

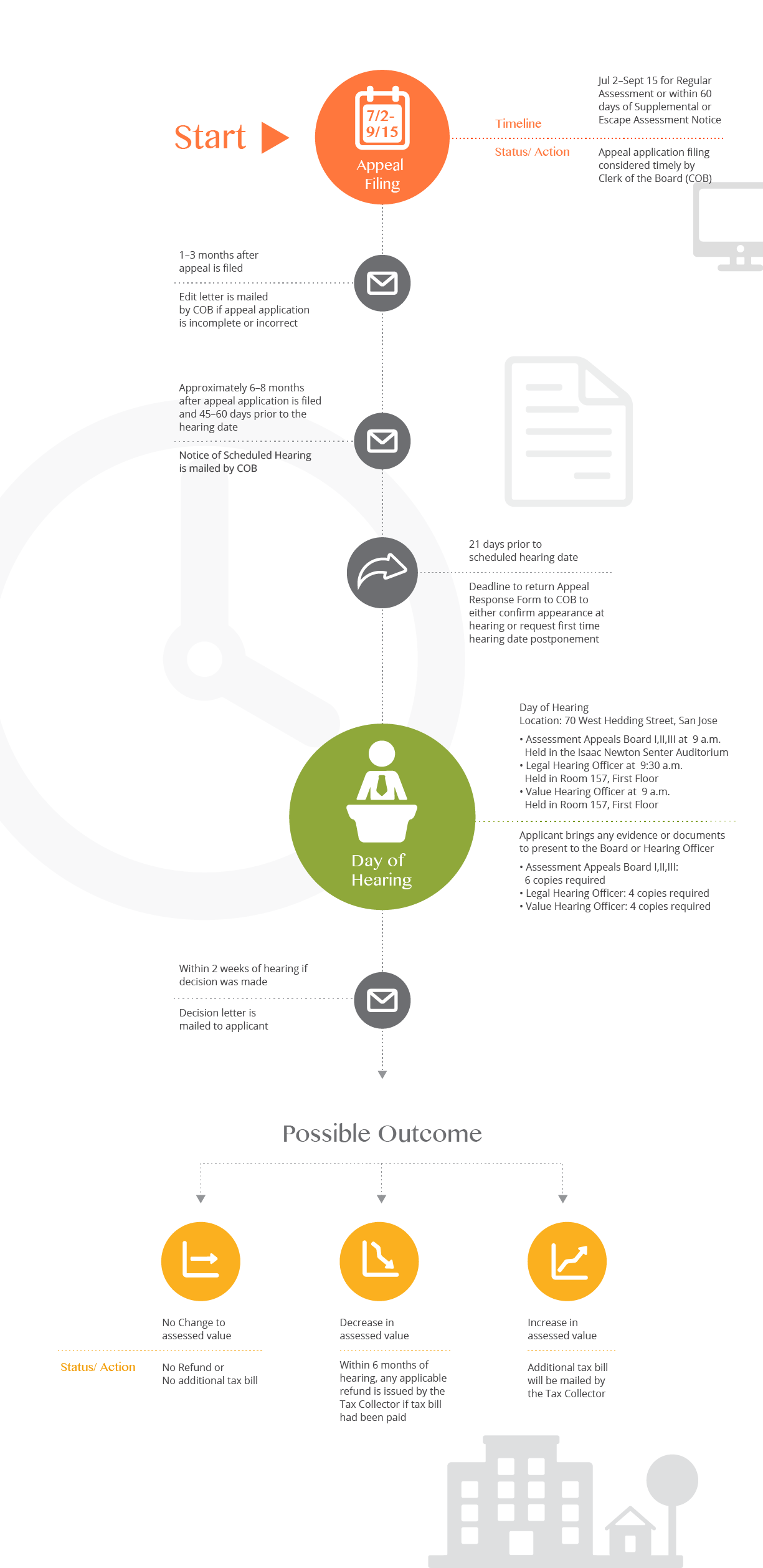

Street Address Unit Search By Address. Appeal applications must be filed between July 2 to September 15 with the Clerk of the Board. If the last day of the filing period falls on a weekend or holiday an application filed on the next business day shall be deemed timely filed.

Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. Appeal Decisions Form. However most business can be conducted by phone email or via web services.

July 2 - September 15 2021 - Regular Filing Period Timeframe for filing application appealing the Regular Assessment with the Clerk of the Assessment Appeals Board. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. We offer drop-in or appointment service for visitors to the office.

County of Santa Clara. Forms Publications and Brochures - Office of the Clerk of the Board of Supervisors - County of Santa Clara Home Assessment Appeals Forms Publications and Brochures Forms Publications and Brochures AgentAttorney Authorization Form - For use with initial filing of appeal. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

Santa Clara County Assessors Public Portal. If you have questions or need assistance please call 408 808-7900 from 900 AM to 400 PM on Monday-Friday or email at DTAC-CancelPenaltyfin. Appeal of Supplemental or Escape Assessment within 60 days from the date of the assessment.

Santa Clara County Property Values Subject to Decreases via Appeal Despite Mid-Pandemic Inflation January 2022 At the end of December 2021 Santa Clara County Assessors office officials commented on the state of property valuation in light of the impact COVID-19 has had on real estate in the area. Property taxes are levied on land improvements and business personal property. Appeal of Regular Assessment during the Regular Filing Period July 2 September 15.

Find the right Santa Clara Property Tax Appeals lawyer from 2 local law firms. Applications may include but are not necessarily limited to Decline in Value Base Year Value Personal Property and Penalty Assessment. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median.

Appeal in 2 minutes or less. Each three member Assessment Appeals Board which is independent of the Assessor and trained by the State Board of Equalization consists of private sector property tax professionals CPAs Attorneys and appraisers appointed by the Santa Clara County Board of Supervisors. Find a local Santa Clara California Property Tax Appeals attorney near you.

Choose from 3 attorneys by reading reviews and considering peer ratings. Santa Clara County California Property Tax Appeal Save thousands by filing a property tax appeal. File with TaxProper in under two minutes only pay if you save.

Santa Clara County Ca Property Tax Search And Records Propertyshark

California Public Records Public Records California Public

Search Results Archives Santa Clara County Board Of Supervisors

Office Of The County Executive Office Of The County Executive County Of Santa Clara

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Office Of The Assessor

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Independent Contractor Agreement Form 11 Subcontractor Agreement Template For Successful Contrac Contractor Contract Contract Template Construction Contract

Santa Clara Shannon Snyder Cpas

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Assessment Appeal Process Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Ca Property Tax Search And Records Propertyshark

Santa Clara County Property Tax Tax Assessor And Collector

The Santa Clara County Coalition Behavioral Health Services County Of Santa Clara